If you’ve received that dreaded message — “Your account has been permanently limited” or “We’ve deactivated your Stripe account” — you’re not alone.

Thousands of business owners and entrepreneurs find themselves banned from PayPal or Stripe each year, often without warning. Whether you’re running a dropshipping store, a high-risk business, or selling digital products, losing your payment processor can feel like hitting a wall.

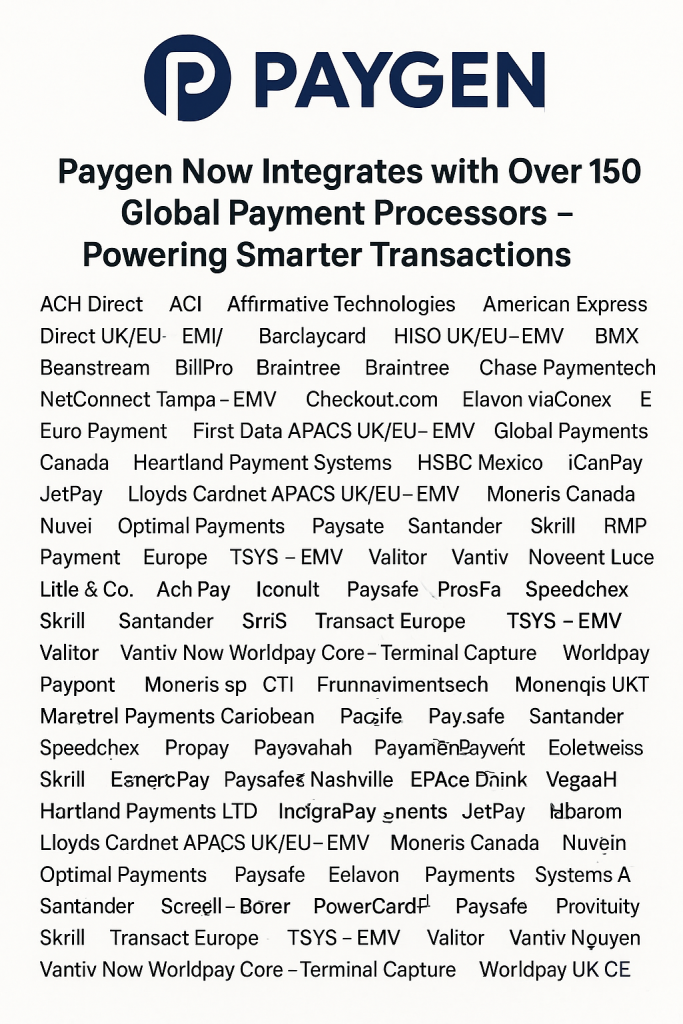

But here’s the good news: you don’t have to shut down your business. At Paygen, we specialize in helping banned or high-risk merchants get back to accepting payments fast — without the red tape.

⚠️ Why Stripe and PayPal Ban Accounts

Both platforms are known for strict risk and compliance policies. Here are common reasons businesses get banned:

- Selling “high-risk” products like CBD, supplements, adult content, forex, or coaching services

- Using PayPal for dropshipping or non-traditional fulfillment methods

- Chargeback rates that exceed platform limits

- Recurring/subscription models flagged by Stripe

- Sudden spikes in sales volume

- Operating from a country not supported by PayPal or Stripe

If any of this sounds familiar, you’re likely searching for:

PayPal banned me, Stripe account deactivated, high-risk merchant account, alternative to PayPal, Stripe replacement, payment processor for banned users

✅ What to Do After Getting Banned

Instead of scrambling for workarounds or setting up another account that might get banned again, you need a real, stable solution.

That’s where Paygen comes in.

We help merchants who’ve been:

- Banned from PayPal or Stripe

- Flagged for high-risk activity

- Operating in restricted regions

- Running subscription or recurring businesses

With us, you can access:

- A fully functional merchant account

- eCheck/ACH solutions for U.S. clients

- Credit card processing for CBD, adult, coaching, finance, crypto, and more

- Support for merchants from the US, UK, Canada, Nigeria, UAE, and other regions

🔁 Accept Payments Again — In 24 to 72 Hours

Paygen offers a seamless onboarding process. You don’t need to “hide” your business model or lie about your industry — we work with honest, transparent risk categories.

Whether you’re searching for:

Stripe banned account, PayPal alternative, PayPal permanently limited, high-risk payment processor, emergency payment gateway, banned by payment gateway, dropshipping banned by PayPal

…you’ll find a reliable home at Paygen.

🔒 Built for High-Risk, Ready for Scale

We believe every business deserves a way to get paid, no matter the niche. That’s why Paygen is trusted by coaches, adult businesses, digital service providers, and ecommerce entrepreneurs who’ve been left behind by traditional processors.

🔗 Ready to Get Started?

Don’t let PayPal or Stripe determine your business future. Join hundreds of merchants who made the switch to Paygen.

👉 Apply for a merchant account now

👉 Apply for a eCheck/ACH processing account now

👉 Or chat with our team for help

Recent Comments